Bloody thing wouldnt fit in my pocket anyway, would have to leave it in the backyard ! :/

-

Please join our new sister site dedicated to discussion of gold, silver, platinum, copper and palladium bar, coin, jewelry collecting/investing/storing/selling/buying. It would be greatly appreciated if you joined and help add a few new topics for new people to engage in.

Bullion.Forum

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold Price Discussion

- Thread starter Nugget

- Start date

Help Support Prospecting Australia:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

Me thinks you have a severe case of "Goldus Fevirechnesata" M.T.  (Don't look it up , I just invented it!)

(Don't look it up , I just invented it!)

shakergt

Moderating Team

Brutus and me said:I bought my first few ounces a few weeks ago. With more to come.

I think within the next few years, especially if Trump gets re elected, countries will start to move away from the US dollar.

Quite a few countries are talking about it already. The more tariffs this guy imposes the better it will be for gold prices.

Once China, Russia, Venezuela, Iran, Poland, India and the like realise the benefits far outweigh the negatives it will happen.

On the other hand if you own US dollars i wouldnt be holding onto them for very long.

Trump has improved the US economy since taking over.

Most western Nations including Australia have had economic declines by closing their own industries for cheap labour countries that make crappy

products.

I can see why globally and economically we are headed away from relying on one global currency.

The debt burden of many Nations and low interest rates are possible drivers for gold price.

Plus the emerging Middle class in India and China.

Just this week i heard some very knowledgable economic persons saying the current Trade war with US & China will be over soon, its not a very long process that

will go on for years. Just think of the Industrial Rust Belt of the USA, where many where once employed in manufacturing, those persons supported Trump in the hope of getting their jobs back.

I need to add the AUD is falling against the USD and is tipped to fall further, which does not benefit the Aussie Consumer, especially when purchasing imported products.

Goldchaser1

dave

Swinging & digging said:Brutus and me said:I bought my first few ounces a few weeks ago. With more to come.

I think within the next few years, especially if Trump gets re elected, countries will start to move away from the US dollar.

Quite a few countries are talking about it already. The more tariffs this guy imposes the better it will be for gold prices.

Once China, Russia, Venezuela, Iran, Poland, India and the like realise the benefits far outweigh the negatives it will happen.

On the other hand if you own US dollars i wouldnt be holding onto them for very long.

Trump has improved the US economy since taking over.

Most western Nations including Australia have had economic declines by closing their own industries for cheap labour countries that make crappy

products.

I can see why globally and economically we are headed away from relying on one global currency.

The debt burden of many Nations and low interest rates are possible drivers for gold price.

Plus the emerging Middle class in India and China.

Just this week i heard some very knowledgable economic persons saying the current Trade war with US & China will be over soon, its not a very long process that

will go on for years. Just think of the Industrial Rust Belt of the USA, where many where once employed in manufacturing, those persons supported Trump in the hope of getting their jobs back.

I need to add the AUD is falling against the USD and is tipped to fall further, which does not benefit the Aussie Consumer, especially when purchasing imported products.

Best thing they ever did,put a business man in charge,he made me laugh the other day,talking about the french wine tariffs,the link below.....

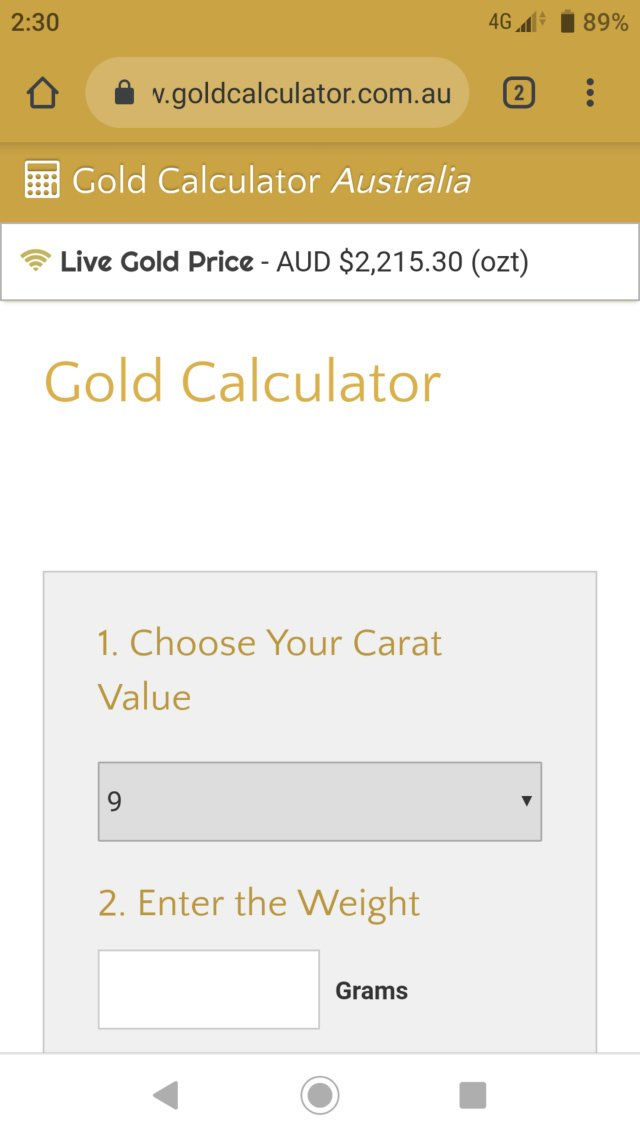

Still at $68 a gram this morning.

https://youtu.be/3Vrgh6e2IBg

Brutus and me

Guy

I guess its how you look at it and where you get your news from...

China wont concede, they play the long game always have. Trump wont concede, will hurt his ego to much.

Doesn't matter if we agree or not, China is the future and we are in prime position to capitalise of we are smart.

Gold up again

Tariffs up again

More farmers in the USA are going bankrupt than ever before.

I have no problem with Trump either way,

I dont like the guy but he is creating alot of distrust in the USA which is long overdue.

My concern here is gold price and the move away from the US dollar which is happening.

I dont think we can talk politics here but just being asked to host missiles here must show what this current gov is like in the US.

But back to gold prices,,,,,

The news just gets better.

https://www.youtube.com/watch?v=xQoGwE7ogJE

China wont concede, they play the long game always have. Trump wont concede, will hurt his ego to much.

Doesn't matter if we agree or not, China is the future and we are in prime position to capitalise of we are smart.

Gold up again

Tariffs up again

More farmers in the USA are going bankrupt than ever before.

I have no problem with Trump either way,

I dont like the guy but he is creating alot of distrust in the USA which is long overdue.

My concern here is gold price and the move away from the US dollar which is happening.

I dont think we can talk politics here but just being asked to host missiles here must show what this current gov is like in the US.

But back to gold prices,,,,,

The news just gets better.

https://www.youtube.com/watch?v=xQoGwE7ogJE

Brutus and me

Guy

"$2173.00 Aud an ounce today"

I know nothing but what I see, hear, study on my own, never played the stock market, so I understand people saying I am talking out my ass.

But I think it will hit 3000 by dec 2020

I know nothing but what I see, hear, study on my own, never played the stock market, so I understand people saying I am talking out my ass.

But I think it will hit 3000 by dec 2020

- Joined

- Mar 10, 2016

- Messages

- 7,955

- Reaction score

- 16,055

And it just keeps going up, hovered around the 2050.00 /2100.00 mark for a week or two and has made steady gains in the past week.

Brutus and me

Guy

The things I am considering,,,

1. Top of the list, research how much US debt sold and gold bought by China since 2016.

2. The US dollar..... Its only worth anything whilever its the worlds trading currency.

They are broke. With wars possible v Iran or Venezueala at any time this wont help them.

Russia now offers the worlds best missile defence system cheaper than the US version.

Turkey atm is the only country that has woken up. The more tariffs the EU receive the more Nato will move away from the

Alliance. Iran and Venz must sell oil to be a viable nation. Do you really think China and Russia wont help them somehow?

Of course they will, which will be the catalyst for the move to gold. China with the silk road initiative are gaining more and more allies

around the world. This really isn't a bad thing, I can see the USA attacking us if we don't follow them more than I fear china.

3. Oil,,,, as mentioned before a lot of countries don't like the US controlling how and who can sell oil. If it was iron ore would we?

4. Russia, China alliance , it will happen. Germany taking gas from Russia now despite the USA threatening sanctions?

Really would you like the USA telling us who and how we deal with other countries around the world?

we would be hit with sanctions also. Its happening slowly but there is a limit that others will put up with.

The biggest hurdle is fear of China and Russia. This is slowly eroding.

All these things will affect the gold price

But gold just keeps rising

1. Top of the list, research how much US debt sold and gold bought by China since 2016.

2. The US dollar..... Its only worth anything whilever its the worlds trading currency.

They are broke. With wars possible v Iran or Venezueala at any time this wont help them.

Russia now offers the worlds best missile defence system cheaper than the US version.

Turkey atm is the only country that has woken up. The more tariffs the EU receive the more Nato will move away from the

Alliance. Iran and Venz must sell oil to be a viable nation. Do you really think China and Russia wont help them somehow?

Of course they will, which will be the catalyst for the move to gold. China with the silk road initiative are gaining more and more allies

around the world. This really isn't a bad thing, I can see the USA attacking us if we don't follow them more than I fear china.

3. Oil,,,, as mentioned before a lot of countries don't like the US controlling how and who can sell oil. If it was iron ore would we?

4. Russia, China alliance , it will happen. Germany taking gas from Russia now despite the USA threatening sanctions?

Really would you like the USA telling us who and how we deal with other countries around the world?

we would be hit with sanctions also. Its happening slowly but there is a limit that others will put up with.

The biggest hurdle is fear of China and Russia. This is slowly eroding.

All these things will affect the gold price

But gold just keeps rising

Brutus and me

Guy

worth watching,

https://www.youtube.com/watch?v=24wsVVo_g-I

https://www.youtube.com/watch?v=24wsVVo_g-I

1. Top of the list, research how much US debt sold and gold bought by China since 2016.

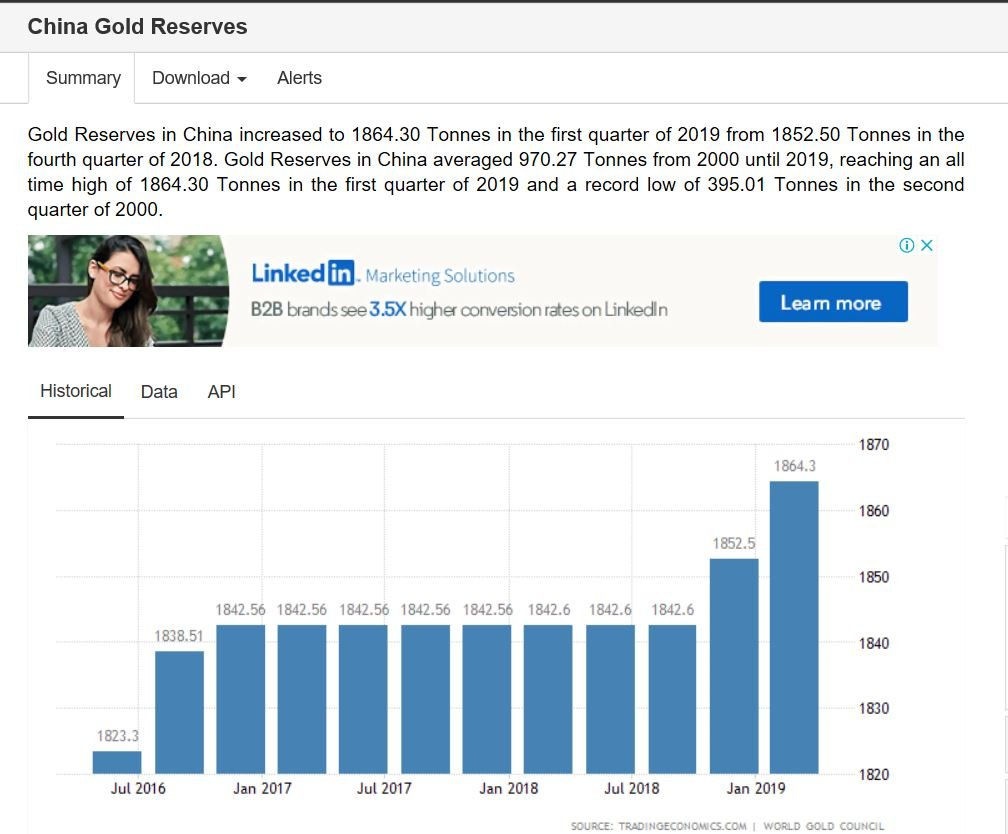

China's gold fairly insignificant, about one quarter of America at best. More to the point, gold is only about 2% of its foreign reserves (compared with 75% for America).

2. The US dollar..... Its only worth anything whilever its the worlds trading currency.

Yes, but it is not them that decides that - and the use of other currencies as well does not decrease its value

They are broke. With wars possible v Iran or Venezueala at any time this wont help them.

What does "broke" mean? Are you referring to their balance of payments? Not much evidence of them being broke. And wars can be great for economies, it depends on the nature of the wars (and I don't see them having either the interest or stomach for foreign wars - Middle Eastern oil is no longer very relevant to them, as they are now essentially self-sufficient in oil). Australia's economy is in a far more vulnerable position. The EU and Britain also have issues. Economic chaos is possible, but it is unlikely to be because of a "broke" USA.

Russia now offers the worlds best missile defence system cheaper than the US version.

Considering they BOTH have enough to wipe out civilization already, how is the amount it cost to make them relevant? And you only need to use a defence system if someone is silly enough to attack you (did you see America going to war over Crimea or the rest of the Ukraine). Russia/s economy is almost ENTIRELY dependent on selling gas and oil to Europe, Europe's economy is hugely dependent on receiving it. Much of it is piped through the Ukraine. Not much incentive for war (other than the low-scale type we see in the Ukraine)

Turkey atm is the only country that has woken up. The more tariffs the EU receive the more Nato will move away from the

Alliance.

Not clear what you are referring to - no tariffs on Turkey are there? It is simply increasingly aligning itself with Russia. What tariffs has America imposed on the EU? And the EU is very dependent on NATO as it has let its own defences slide.

Iran and Venz must sell oil to be a viable nation. Do you really think China and Russia wont help them somehow?

Sanctions against Iran were imposed by the UN Security Council, of whom China and Russia are permanent members (who could therefore veto any sanctions if they wanted to). Sanctions against Venezuela are imposed by individual countries, and China and Russia support its socialist dictatorship in principle, but have little to gain by supporting it militarily (Russia does not need its oil and gas). And of course its second largest product is gold. Iran is complex for Russia - it adjoins its border and it must be dubious about it being a nuclear power, and about any chance it could align with America (not a great risk). I suspect support by both for both is just intended as an annoyance to the USA.

China with the silk road initiative are gaining more and more allies around the world.

Yes, by trade and loans - as the USA did after WW2.

I can see the USA attacking us if we don't follow them more than I fear china.

How is that realistic? We are hardly likely to move to a military alliance with China in the near future, and we are largely irrelevant to America - they don't need to attack us, they simply need to cease protecting us.

I think the world economy is in a shaky state and gold will be high for some time (but if you did not already hold it you may have missed out on speculating, but it hedges against disaster in a collapse). But I don't think the reasons you give are the main issues, except for multiple issues with the world economy. China buying gold will have left it sitting pretty now it has devalued, Russia has long used it as a hedge against depreciation of its economy. But Russia is a small player, with six times Australia's population but an economy only very slightly larger than Australia.

China's gold fairly insignificant, about one quarter of America at best. More to the point, gold is only about 2% of its foreign reserves (compared with 75% for America).

2. The US dollar..... Its only worth anything whilever its the worlds trading currency.

Yes, but it is not them that decides that - and the use of other currencies as well does not decrease its value

They are broke. With wars possible v Iran or Venezueala at any time this wont help them.

What does "broke" mean? Are you referring to their balance of payments? Not much evidence of them being broke. And wars can be great for economies, it depends on the nature of the wars (and I don't see them having either the interest or stomach for foreign wars - Middle Eastern oil is no longer very relevant to them, as they are now essentially self-sufficient in oil). Australia's economy is in a far more vulnerable position. The EU and Britain also have issues. Economic chaos is possible, but it is unlikely to be because of a "broke" USA.

Russia now offers the worlds best missile defence system cheaper than the US version.

Considering they BOTH have enough to wipe out civilization already, how is the amount it cost to make them relevant? And you only need to use a defence system if someone is silly enough to attack you (did you see America going to war over Crimea or the rest of the Ukraine). Russia/s economy is almost ENTIRELY dependent on selling gas and oil to Europe, Europe's economy is hugely dependent on receiving it. Much of it is piped through the Ukraine. Not much incentive for war (other than the low-scale type we see in the Ukraine)

Turkey atm is the only country that has woken up. The more tariffs the EU receive the more Nato will move away from the

Alliance.

Not clear what you are referring to - no tariffs on Turkey are there? It is simply increasingly aligning itself with Russia. What tariffs has America imposed on the EU? And the EU is very dependent on NATO as it has let its own defences slide.

Iran and Venz must sell oil to be a viable nation. Do you really think China and Russia wont help them somehow?

Sanctions against Iran were imposed by the UN Security Council, of whom China and Russia are permanent members (who could therefore veto any sanctions if they wanted to). Sanctions against Venezuela are imposed by individual countries, and China and Russia support its socialist dictatorship in principle, but have little to gain by supporting it militarily (Russia does not need its oil and gas). And of course its second largest product is gold. Iran is complex for Russia - it adjoins its border and it must be dubious about it being a nuclear power, and about any chance it could align with America (not a great risk). I suspect support by both for both is just intended as an annoyance to the USA.

China with the silk road initiative are gaining more and more allies around the world.

Yes, by trade and loans - as the USA did after WW2.

I can see the USA attacking us if we don't follow them more than I fear china.

How is that realistic? We are hardly likely to move to a military alliance with China in the near future, and we are largely irrelevant to America - they don't need to attack us, they simply need to cease protecting us.

I think the world economy is in a shaky state and gold will be high for some time (but if you did not already hold it you may have missed out on speculating, but it hedges against disaster in a collapse). But I don't think the reasons you give are the main issues, except for multiple issues with the world economy. China buying gold will have left it sitting pretty now it has devalued, Russia has long used it as a hedge against depreciation of its economy. But Russia is a small player, with six times Australia's population but an economy only very slightly larger than Australia.

The world continually changes, and I often see outdated statements here. It is often stated here that the US dollar IS the world's trading currency, but it is becoming only ONE of the world's trading currencies (albeit still the largest).

"In 2007, former Federal Reserve Chairman Alan Greenspan said the euro could replace the dollar as a world currency. At the end of 2006, 25 percent of all foreign exchange reserves held by central banks were in euros, compared to 66 percent in dollars. Furthermore, 39 percent of cross-border transactions were being done in euros, compared to 43 percent in dollars. In many areas of the world, the euro is replacing the dollar. The euro's strength is because the European Union has now become one of the world's largest economies. Even if the euro is destined to replace the dollar, it would happen slowly. It would not cause a dollar collapse because its in no one's best interest. A dollar collapse would destroy the entire global economy. Also, the United States is the world's best customer. The countries that could cause a dollar collapse are the same ones who need Americans to keep buying their products. As a result, they have no incentive".

The Chinese currency, Japanese Yen and the British Pound are therefore significant world trading currencies, the US only accounting for two-thirds of holdings and well under half of cross-border transactions. And many countries peg their currencies to the US dollar, so any collapse in it is not necessarily in their interests. China used to be pegged to it, but now pegs its currency to a basket of currencies. Many countries hold a mixture of currencies in their central banks, not just - and sometimes a minority of - US dollars (at the end of June 2018, euro made up 32 % of Russias currency and gold reserves, dollar 22% and yuan 15 %).

"In 2007, former Federal Reserve Chairman Alan Greenspan said the euro could replace the dollar as a world currency. At the end of 2006, 25 percent of all foreign exchange reserves held by central banks were in euros, compared to 66 percent in dollars. Furthermore, 39 percent of cross-border transactions were being done in euros, compared to 43 percent in dollars. In many areas of the world, the euro is replacing the dollar. The euro's strength is because the European Union has now become one of the world's largest economies. Even if the euro is destined to replace the dollar, it would happen slowly. It would not cause a dollar collapse because its in no one's best interest. A dollar collapse would destroy the entire global economy. Also, the United States is the world's best customer. The countries that could cause a dollar collapse are the same ones who need Americans to keep buying their products. As a result, they have no incentive".

The Chinese currency, Japanese Yen and the British Pound are therefore significant world trading currencies, the US only accounting for two-thirds of holdings and well under half of cross-border transactions. And many countries peg their currencies to the US dollar, so any collapse in it is not necessarily in their interests. China used to be pegged to it, but now pegs its currency to a basket of currencies. Many countries hold a mixture of currencies in their central banks, not just - and sometimes a minority of - US dollars (at the end of June 2018, euro made up 32 % of Russias currency and gold reserves, dollar 22% and yuan 15 %).

Brutus and me

Guy

1. Top of the list, research how much US debt sold and gold bought by China since 2016.

China's gold fairly insignificant, about one quarter of America at best. More to the point, gold is only about 2% of its foreign reserves (compared with 75% for America)

https://www.youtube.com/watch?v=CiCsKqak4qY

25% of what the USA has???????

i wont bother going through the rest............

Tariffs/sanctions on germany? i think there could be

China's gold fairly insignificant, about one quarter of America at best. More to the point, gold is only about 2% of its foreign reserves (compared with 75% for America)

https://www.youtube.com/watch?v=CiCsKqak4qY

25% of what the USA has???????

i wont bother going through the rest............

Tariffs/sanctions on germany? i think there could be

Brutus and me

Guy

Depends how you look at it,,,,,,,

Foreign debt at its highest level,

More people going bankrupt than ever before,

Infastructure falling apart.

More people falling below the poverty line than ever before,

Geez has flint michigan even got fresh water yet? its been years.

compared to,

500 million bought out of poverty,

world leaders in renewable tech

and the real clincher, something like 90% of rare earth metals which it really doesnt need to trade

Our future is with China we just havnt realised it yet.

Foreign debt at its highest level,

More people going bankrupt than ever before,

Infastructure falling apart.

More people falling below the poverty line than ever before,

Geez has flint michigan even got fresh water yet? its been years.

compared to,

500 million bought out of poverty,

world leaders in renewable tech

and the real clincher, something like 90% of rare earth metals which it really doesnt need to trade

Our future is with China we just havnt realised it yet.

Brutus and me

Guy

he just hasnt got round to it yet

https://www.cnbc.com/2019/06/12/tru...ring-slapping-sanctions-on-nord-stream-2.html

https://www.cnbc.com/2019/06/12/tru...ring-slapping-sanctions-on-nord-stream-2.html

Brutus and me said:1. Top of the list, research how much US debt sold and gold bought by China since 2016.

China's gold fairly insignificant, about one quarter of America at best. More to the point, gold is only about 2% of its foreign reserves (compared with 75% for America)

https://www.youtube.com/watch?v=CiCsKqak4qY

25% of what the USA has???????

i wont bother going through the rest............

Tariffs/sanctions on germany? i think there could be

Yes, about 25% - you need to be careful of your source.

Perhaps you should go through the rest..... :|

Sanctions on Germany???????????????

Brutus and me

Guy

oh your using a list 12 mths old,,,,,

as it said in the vid i posted,,,,,, they now own more gold than usa....

but fox prob disagrees......

as it said in the vid i posted,,,,,, they now own more gold than usa....

but fox prob disagrees......

Similar threads

- Replies

- 7

- Views

- 892