This is in answer to a question elsewhere, that I referred to here (I am not sure of the best place to put it). I have made it a new topic because the gold price keeps cropping up all over the place - there seem to be many misconceptions (eg people saying we should get back on the gold standard as if that were easy to do, cartels or countries cornering supply, or being unaware of how the gold price operates in different currencies) and I get a bit weary of writing the same things in reply. I hope this helps. I am no expert but I am informed enough to be asked to lecture on the topic of metal prices for industry at times. I imagine there were a number of other reasons (e.g. a warping of economies if there were an extremely high gold price, by biasing the wealth of a country's wealth towards possessing or having reserves of a metal rather than to the health of different countries' economies). I imagine this could have other implications (causing countries to go bankrupt without good cause, rampant inflation in some countries - my assumptions). For example, Russia alone would produce enough gold in 10 years to equal a quarter of all gold in Fort Knox despite having an economy smaller than Australia at present, most of Europe could never produce gold - and Japan very little - despite having mammoth economies. Russia, America, China and Australia would dominate the world in this respect and would together equal Fort Knox in 10 years. However this would still be miniscule to what would be required to make gold a currency standard again - the world economy is just too large.

Gold is not a normal commodity, related to supply and demand like iron ore or coal - the world has produced about a thousand tonnes less than we need every year for decades now (we produce around 3000 tonnes per year, need 4000 - the exact figure might be out of date slightly). This was a major reason why we dropped the gold standard years ago (we just could not find even remotely enough gold to store to "guarantee" our currencies, so swapped to paper money standards). The $US became the main standard because its economy was considered too large to completely fail (ha! - fortunately we are moving to a basket of currencies as a standard).

The gold price is mostly kept fairly constant by other means than variation in its price and our annual gold mine production rate (no, not buying by cartels etc., and mostly not by buying and selling of national gold reserves - their holdings are far too small). We make up the difference by the turnover and melting down of gold jewellery etc., new jewellery being the overwhelmingly dominant use of gold and nearly all gold ever produced by humans still being in circulation. It is not an industrial metal to any degree, nor is much lost forever (literally, or figuratively due to burial in landfill or decay in the ground to soluble salts like silver, copper, lead, zinc etc.).

Minerals other than gold, eg iron ore, are all commodities, and their price fluctuates with supply and demand - iron ore went down in price because China did not immediately need as much because it had stockpiled a lot in reserve (decreased demand), and Brazil and India etc became major producers competing with Australia and could undersell us (increased supply). Our government tends to demonize miners a bit and claim that we are the lucky country because of our minerals in the ground and that companies should feel privileged to mine them (it is actually our extremely efficient mining and our ability to increase production at short notice, partly because of flat land and climate, that makes us "lucky") - we are just damned good at it and have a skilled and educated labour force to do it. Mining companies pay royalties (which are a charge per tonne before any profit and can equal 10%), are then taxed like other companies, and will no doubt soon have a mining tax added, despite being in an industry that sees more boom and bust than any other. If you can't make a good profit in booms, you cannot have cash in reserve to carry you through busts, nor to explore for new mines. And opening a new mine in the jungle or swamps or the Andes or at minus 50 degrees Celsius or with 10 metres annual rainfall is not a minor undertaking compared to the ease of opening a new pit in our deserts - countries like South Africa, many African countries including iron in the DRC and Cameroun, India, Chile, Brazil, China, Russia are just as lucky in terms of the amount of potential ore in the ground (even the USA for gold). I suspect (my assumption) that Australia will run out of available saleable ore of all mineral types sooner than many of these countries, not because we won't still have it in the ground but because we tie up far more in National Parks or through other restrictions (the Powerful Owl, Bentwing Bat, a moth near Kilmore, numerous plant species, sacred sites, landowner restrictions). For example the amount of Victoria that has potential gold where you are permitted to explore and mine would not be a tiny fraction of what it was in 1851, and I expect will soon drop to far less than 10%, not of Victoria but of areas where gold occurs (so don't expect a major future gold-rush). Not a value judgement, many of these things have some validity or fairness, and coal strip mining in the Appallachian forests where they can pump waste rock into their rivers is not pretty - common sense is needed on all sides. However mining is 40% of our exports and increasing (agriculture 22% and declining, education 10%, tourism-related 10%, manufacturing 10%) - a scarey breakdown when tourism is related to fuel prices, manufacturing in a death-spiral and education dropped 40% one year because two Indian taxi-drivers were beaten up in Melbourne. Since before I graduated in the 1960s we were saying we had to get smarter and move away from dependence on mining - but we have constantly increased that while decreasing our potential to find more mines.

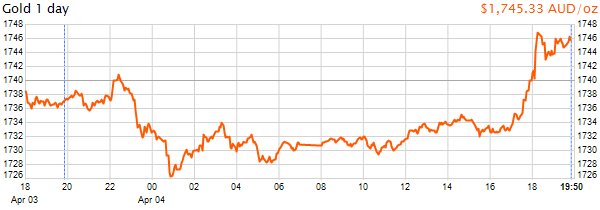

Because it is not a commodity the gold price has really been fairly steady for some time in $US, except for a slight increase in US$ price recently due to market panic because of threats of nuclear and other war (North Korea, Iran) and Trumps very risky trade tarrifs causing fear of an international trade war affecting currencies - so more individuals buy a bit of gold to hedge against possible companies going under, currencies crashing, rampant inflation etc. (e.g. much of China's gold buying is by individuals, not the government). There have also been blips with threats of Greece, Spain, Portugal, France and Italy going bankrupt, Greece being the main serious threat. Those fears are nearly all lessening slightly and gold price is decreasing in $US.

The Australian dollar gold price is almost totally dependent on only the $US price and the exchange rate between the $US and $A. With a constant $US gold price (it is quoted in $US dollars because the $US dollar is now the de facto currency standard), then when our dollar strengthens against the $US the Australian gold price drops because of the change in exchange rate. When our dollar weakens, the Australian gold price increases. It all has to do ultimately with balance of payments and that to buy something from another country you have to pay them in their currency or a de facto standard like the $US, although the Euro and Japanese yen are increasingly being accepted as well. In most cases you do not buy imports directly in $A, but firstly (and usually invisibly to you) are buying the export countries currency or an accepted de facto standard currency with which you pay for the goods.

Apologies for length, but there are many related factors....