I used to trade commodities futures

There are some things that cant be discussed on internet forums as you would quickly find your computer hac ked and you would be targeted for 'unwanted attention' that would render you being incapable of participating in the equities business.

What some bloke might say is that every commodity and market is now heavily influenced by major banks and trading houses who all use " black box " trader bots , these are massive computers that use sophisticated software to engage in automated trades , some of them capable of executing 10,000 trades per second on pretty much any market they choose.

If they want the market "to move in one direction or another" , they can do so.

A person might also say that a small percentage of 'connected' rich folks at the top are privvy to insider information , they are ahead of the herd and trade with a 'contrarian philosophy' to whatever the herd is doing.

If the media and "equity analysts" are telling you dump ABC it means they are accumulating and manipulating the price down to do so

If they tell you to buy XYZ its because they are selling and setting up short positions to profit when it falls.

Sometimes however , the abovementioned people get screwed by 'unforseen events' , or they cop a loss because another world power takes an opposing trade which they didnt see coming.

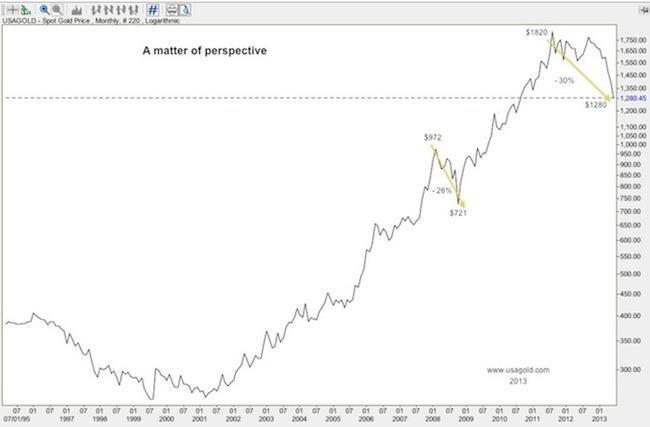

An example might be back around 2008 - 2009 when a euro block superpower' decided to buy gold in one night popping the price up around $100 per ounce , while simultaneously dumping bank stocks in another country' they were having a barny with over some financial instruments they had been sold . said bank stocks fell around 22 - 24% in one session of trade. not one to infer or suggest anything , but whatever the barny was about , they must have gone dancing , kissed , and made up because after they had polite conversations with each other , everything was allowed to return to 'normal' . whatever 'normal' is.

So , while generally the markets are influenced by a very small percentage of players , they are not always on top of things and potential exists for things to turn nasty very very quickly , and the "safeguards" which are supposed to prevent such things may not always save our ass. There is potential for fiscal imbalances to rapidly swing out of control and none of us really know the status of the invisible dominos that can exist out there in the form of 'vapourware' financial instruments , nor what debt obligations might suddenly spiral out of control due to the nature of their construction , or due to sudden massive fluctuations in foreign exchange rates between parties where debt or contractual obligations exist.

Moral of the story :

dont believe everything the'experts' tell you

dont rely on other people to protect your ass

dont expose your ass to highly leveraged positions

dont put all your ***** in one basket

try to have access to a spare ass for emergencies

and be kind to your mother

good luck peepil :8